2-Step FUNDED TRADER PROGRAM

UNLIMITED TIME 2-STEP FUNDING

Unlock your trading potential! Take your time, pass at your own pace, and step into a world where monthly salaries await funded traders. Your journey to success starts here!

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $10,000 | $5,000 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $5,000 | $5,000 | $5,000 |

| Max Absolute Drawdown | $10,000 | $10,000 | $10,000 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $519 | - | Refund |

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $5,000 | $2,500 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $2,500 | $2,500 | $2,500 |

| Max Absolute Drawdown | $5,000 | $5,000 | $5,000 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | Up to $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $329 | - | Refund |

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $2,500 | $1,250 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $1,250 | $1,250 | $1,250 |

| Max Absolute Drawdown | $2,500 | $2,500 | $2,500 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | Up to $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $179 | - | Refund |

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $1,000 | $500 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $500 | $500 | $500 |

| Max Absolute Drawdown | $1,000 | $1,000 | $1,000 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | Up to $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $99 | - | Refund |

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $500 | $250 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $250 | $250 | $250 |

| Max Absolute Drawdown | $500 | $500 | $500 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | Up to $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $59 | - | Refund |

| Phase 1 | Phase 2 | Funded | |

|---|---|---|---|

| Time Limit | Unlimited | Unlimited | Unlimited |

| Minimum Trading Days | 5 | 5 | 5 |

| Profit Target | $250 | $125 | Scaling Plans* |

| Profit Share | - | - | 80% - 100% |

| Max Daily Drawdown | $125 | $125 | $125 |

| Max Absolute Drawdown | $250 | $250 | $250 |

| Drawdown Type | Balance Based | Balance Based | Balance Based |

| Monthly Salary | - | - | Up to $500/Month |

| Leverage | 1:33 | 1:33 | 1:33 |

| Refundable Fee | $39 | - | Refund |

Trade a wide variety of assets, including Forex, Indices, Commodities, and Crypto.

Hold your trades over the weekend or overnight. Low swap fees perfect for swing traders.

Feel free to trade the news according to your strategy without any restrictions.

Whether you prefer using EAs, hedging, or discretionary trading, there are no limits or restrictions.

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $100,000 | $10,000 | - | - |

| PHASE 2 | $100,000 | $5,000 | - | REFUND |

| FUNDED LV1 | $100,000 | $10,000 | 80% | $8,000 |

| FUNDED LV2 | $112,500 | $11,250 | 80% | $9,000 |

| FUNDED LV3 | $125,000 | $12,500 | 80% | $10,000 |

| FUNDED LV4 | $150,000 | $15,000 | 80% | $12,000 |

| FUNDED LV5 | $175,000 | $17,500 | 90% | $15,750 |

| FUNDED LV6 | $200,000 | UNLIMITED | 100% | UNLIMITED |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $50,000 | $5,000 | - | - |

| PHASE 2 | $50,000 | $2,500 | - | REFUND |

| FUNDED LV1 | $50,000 | $5,000 | 80% | $4,000 |

| FUNDED LV2 | $75,000 | $7,500 | 80% | $6,000 |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $25,000 | $2,500 | - | - |

| PHASE 2 | $25,000 | $1,250 | - | REFUND |

| FUNDED LV1 | $25,000 | $2,500 | 80% | $2,000 |

| FUNDED LV2 | $37,500 | $3,750 | 80% | $3,000 |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $10,000 | $1,000 | - | - |

| PHASE 2 | $10,000 | $500 | - | REFUND |

| FUNDED LV1 | $10,000 | $1,000 | 80% | $800 |

| FUNDED LV2 | $15,000 | $1,500 | 80% | $1,200 |

| FUNDED LV3 | $20,000 | $2,000 | 80% | $1,600 |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $5,000 | $500 | - | - |

| PHASE 2 | $5,000 | $250 | - | REFUND |

| FUNDED LV1 | $5,000 | $500 | 80% | $400 |

| FUNDED LV2 | $7,500 | $750 | 80% | $600 |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| PHASE 1 | $2,500 | $250 | - | - |

| PHASE 2 | $2,500 | $125 | - | REFUND |

| FUNDED LV1 | $2,500 | $250 | 80% | $200 |

| FUNDED LV2 | $3,750 | $375 | 80% | $300 |

In the first phase of the Challenge Funding Program, you'll be given a demo account to show your trading skills with no time limits.

You'll be given a new demo funded account challenge with the same rules but half the profit target of Phase 1 to confirm your consistency and trading skills.

Trade our funded account challenge to earn between 80% and 100% profit share. Enjoy the added benefit of rapid scaling plans and a monthly salary upon qualifying.

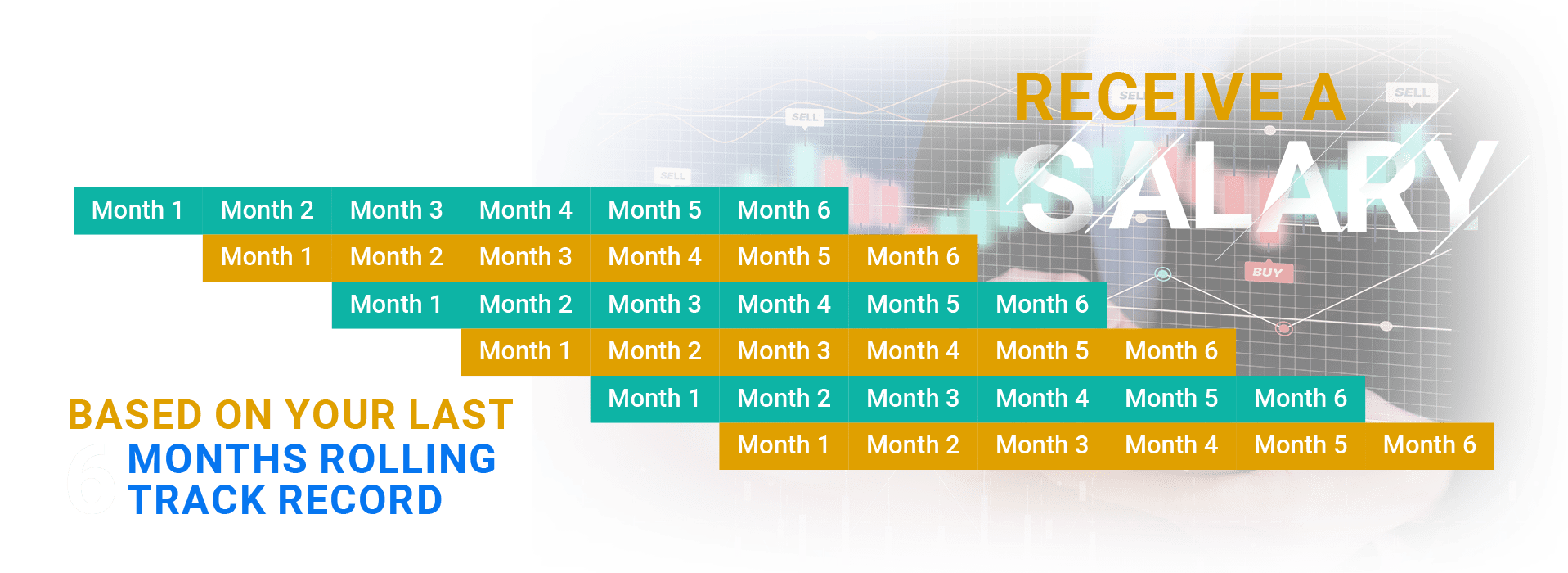

At CTI, we’re taking trader rewards to the next level!

We understand the effort and expertise you put into your trades, and that’s why we are thrilled to introduce our monthly salary for our dedicated CTI traders.

Even if you begin with smaller plans, there’s ample room for growth. As you climb through our scaling plans, your salary isn’t static – it grows with you.

Read our 1,200+ reviews at Trustpilot, Google, & YouTube Success Stories.